Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

market news

Risk aversion continues to push new highs, gold and silver are overbought and many are cautious

Wonderful introduction:

Only by setting off, can you reach your ideals and destinations, only by hard work can you achieve brilliant success, and only by sowing can you reap the rewards. Only by pursuing can you taste upright people.

Hello everyone, today XM Forex will bring you "[XM Forex Platform]: Risk aversion continues to push new highs, gold and silver are overbought and cautious". Hope this helps you! The original content is as follows:

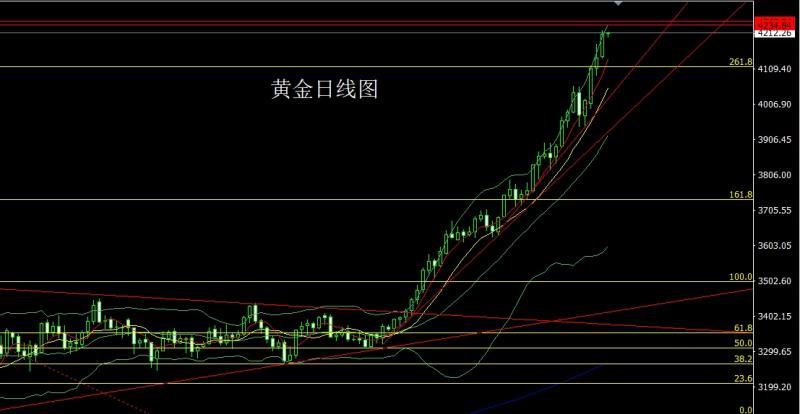

Yesterday, the gold market opened at 4142.3 in early trading, then the market retreated slightly to reach 4139.2, and then the market rose strongly. After breaking the previous day's high, the daily line continued to hit the all-time high. The daily line reached the highest position of 4218.6, and then the market consolidated. The daily line finally closed at 4207.7, and then the market closed with an upper shadow line. The long Yang line closes, and after this form ends, the longs of 3325 and 3322 below and the longs of 3368-3370 last week and the longs of 3377 and 3385 and 3563 will reduce the positions and follow up at 3750. Today, it will fall back to 4180 and stop the loss of 4174. The target will be 4220. If the position is broken, the pressure will be 4232 and 4245-4250.

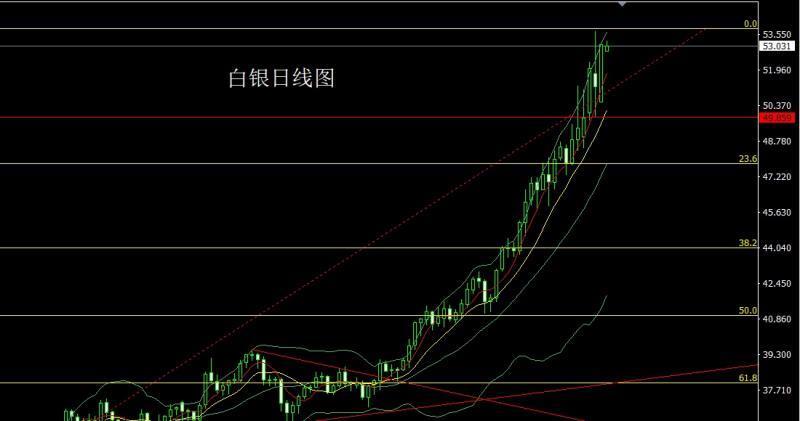

The silver market opened low yesterday at 50.543 and then the market rose directly. The daily line reached the highest level of 53.174 and then the market consolidated. The daily line finally closed at 53.093 and then the market closed with a saturated positive line with a slightly longer upper shadow line. line, and after this pattern ends, the long positions of 37.8, 38.8, and 44.6 will be reduced and the stop loss will be followed up at 47. Today, the stop loss is 51.7, and the target is 53, 53.8, 53.5, 53.8, and 54.

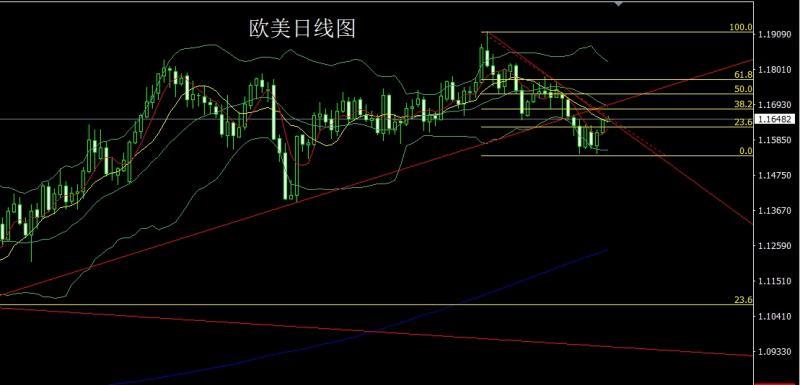

The European and American markets opened at 1.16060 yesterday, then the market retreated slightly to reach 1.16004, and then the market fluctuated and rose. The daily line reached the highest position of 1.16480, and then the market consolidated. The daily line finally closed at 1.16466. After the position, the market closed with a basically saturated Zhongyang line. After this form ended, the stop loss was 1.16000 over 1.16200 today, and the targets were 1.16500, 1.16800 and 1.17000.

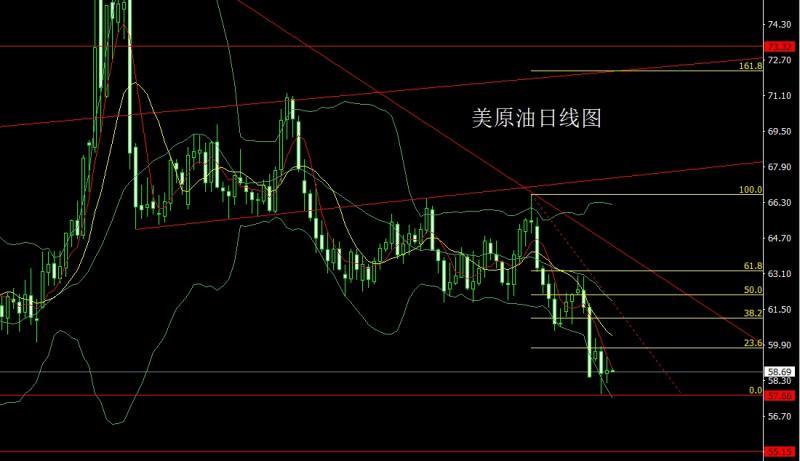

The U.S. crude oil market opened at 58.62 yesterday, and then the market first fell back to 58.37, and then rose strongly. The daily high hit the daily high of 59.42, and then the market fell back strongly. The daily low reached 58.19, and then the market rose in late trading. After the daily line finally closed at 58.77, the daily line closed in the form of a cross star with the upper shadow line slightly longer than the lower shadow line. After such a form ended, it first fell back to 57.9 and stopped at 57.4. The target is 59, 59.6, 60, and 60.5-61.

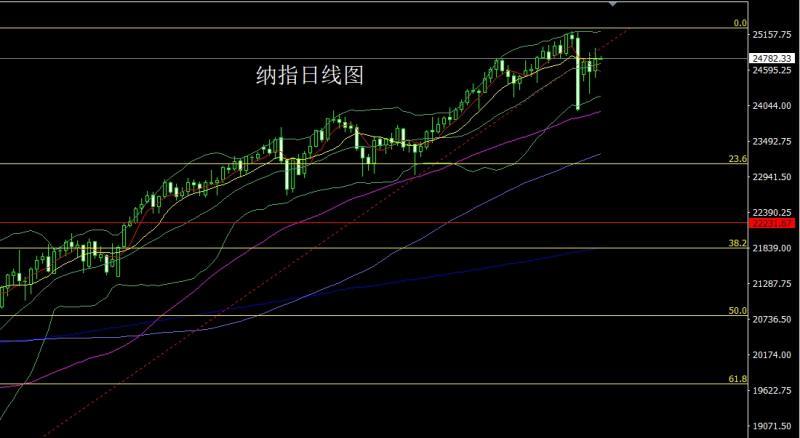

After the Nasdaq opened at 24584.23 yesterday, the market first rose. The daily high hit the position of 24940.38, and then the market fell sharply. After reaching a low of 24482.7, the market rose strongly in late trading. After the daily line finally closed at 24770.11, the daily line closed with a Zhongyang line with the upper shadow line longer than the lower shadow line. This After the end of this pattern, today's stop loss is 24540 over 24600, and the target is 24700, 24800 and 24950.

Fundamentals, yesterday's fundamentals, the US President's remarks have become a theme again. He said that if Hamas does not abide by the ceasefire agreement, Israel will resume operations under his order. The current government authorized the CIA to take covert operations in Venezuela. The US President confirmed this news. The Beige Book showed that consumer spending fell slightly and labor demand was generally sluggish. Therefore, the U.S. index fell under pressure yesterday, while gold, silver and non-U.S. currencies rose. Today's fundamentals focus on the monthly retail sales rate in the United States in September and the annual PPI rate in September in the United States at 20:30, as well as the Philadelphia Fed Manufacturing Index in October. Later, we will look at the 22:00 US October NAHB housing market index and the US August business inventory monthly rate as well as the US initial jobless claims in the week to October 11. However, whether this data can be released depends on whether the US government can end the shutdown.

In terms of operation, gold: the longs of 3325 and 3322 below and the longs of 3368-3370 last week and the longs of 3377 and 3385 and the longs of 3563. After reducing the position, the stop loss will be followed up and held at 3750. Today, it will first fall back to 4180 and stop the loss of 4174. The target is 4220, which is broken.Look at 4232 and 4245-4250 pressure.

Silver: The bottom is 37.8 long, 38.8 long and 44.6 long. After reducing the position, the stop loss is followed up and held at 47. Today, the 52 long stop loss is 51.7. The target is 53 and 53.8, 53.5 and 53.8. and 54.

Europe and the United States: Stop loss is 1.16000 after 1.16200 today, target 1.16500, 1.16800 and 1.17000.

U.S. crude oil: fall back 5 today 7.9 long stop loss 57.4, target 59 and 59.6 and 60 and 60.5-61.

Nasdaq: today 24600 long stop loss 24540, target 24700, 24800 and 249 50.

The above content is all about "[XM Foreign Exchange Platform]: Risk aversion continues to push to new highs, gold and silver are overbought and more cautious". It is carefully xmspot.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here