Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- USD/Canada fell near 1.3720 as USD correction

- How to rewritten the trading logic of the foreign exchange market when volatilit

- 8.19 Gold fell sharply and crude oil fluctuated and rose latest market trend ana

- Super central bank has superimposed large non-farm data on the week, triggering

- Little Bao Fei Ge pushes the US finger, gold and silver continue to rise this we

market news

Gold continues to rise, with a strong consolidation at 4170-4225 tonight

Wonderful introduction:

The breeze in one's sleeves is the happiness of an honest man, a prosperous business is the happiness of a businessman, punishing evil and hoeing an adulterer is the happiness of a knight, being good in character and learning is the happiness of a student, helping those in need and those in need is the happiness of a good person, sowing in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Forex will bring you "[XM official website]: Gold continues to rise, and the high level of 4170-4225 will be strong tonight." Hope this helps you! The original content is as follows:

Zheng’s Silver Points: Gold continues to rise, and the high level of 4170-4225 will consolidate strongly tonight

Reviewing yesterday’s market trends and emerging technical points :

First, gold: It closed strongly at a high level overnight on Monday. You can still try to continue the rise yesterday morning. You have to open at 6 to 7 o'clock to reach a relatively low level. If you get up late and have already pulled up, you don't dare to. Intervene to chase the rise; continue to be bullish with the help of a small pullback at 4132 around 10 o'clock, successfully reaching the 4150 target, and testing the highest 4179; there was a rapid 90-meter dive before the European market. Generally, under the bullish trend, a sharp drop cannot be extended. Continued, so I chose to continue to be bullish on 4110. It was the middle track of the hourly line at the time, and it was also the 618 dividing position when last night's low rose to the intraday high and stepped back. However, the first time it only reached 4111, which was 1 meter away. The second time it stepped back to intervene. , it made a breakthrough and fell to 4090. After forming a double bottom support, it took the bullish call again at 4110 and reached the 4145 target; the European market rebounded as a whole and did not weaken. The US market originally tended to see a second pull-up before testing again. The intraday high was under pressure again, repeating the National Day pattern. However, the price was suppressed again until it broke through 4100 and stabilized. Finally, it continued to rise above 4105, and the target of 4150 was reached in the middle of the night;

Second, silver Aspects: Yesterday's European market dived, relying on the support of 51 to bullish, reaching 51.5 profit; the US market dipped for the second time to 50.6, still bullish, and stabilized close to the daily 5 moving average, and finally reached the 52 target;

Today's market analysis and interpretation:

First, the gold daily level: Monday's close was full of Dayang K, and continued to break through the third cycle high of 4060, then there will be four trading days at a relatively high level, the first two daysIf there are consecutive positive days and the short-selling continues to rise, there will be a yin on the third day and adjust to the 5 moving average or pierce it before closing and stabilizing. On the fourth day, there will be a small yang to continue to stabilize the situation. On the fifth day, there will continue to be a big yang and then break through to the high point of this round. This is a reference to the trend cycle that has been repeated since September 22. There is a high probability that it will still close yang today, and it will be tomorrow. See if the yin closes and then steps back. In the unilateral bullish trend, the yin out is usually a single yin, and the yang will continue to close on Friday to stabilize; we will take one step at a time to see if the cycle continues. Tomorrow, the 5-day moving average support will move up to the 4100 line, and the 10-day moving average will move up to the 4050 line. If the price touches 4100 or breaks through, the outgoing trend will stabilize. They are all squat lows given again. If a rare step back occurs, you must grasp it again in time;

Second, the golden 4-hour level: once this cycle is shorted and pulled up, it is also a situation of consecutive positives and single yin, and relying on the 5th, the extreme 10th support continues to pull up and break high; tonight the 5th support focuses on 4180, 1 The 0-day support focuses on 4156, which is only the corresponding position before 22 o'clock; after 22 o'clock, the support will gradually move up at a speed of 10 meters; only if it effectively falls below the 10-day mark, then the short-term can usher in a slightly larger correction to test the mid-track. It is not expected tonight, so we have to wait until tomorrow;

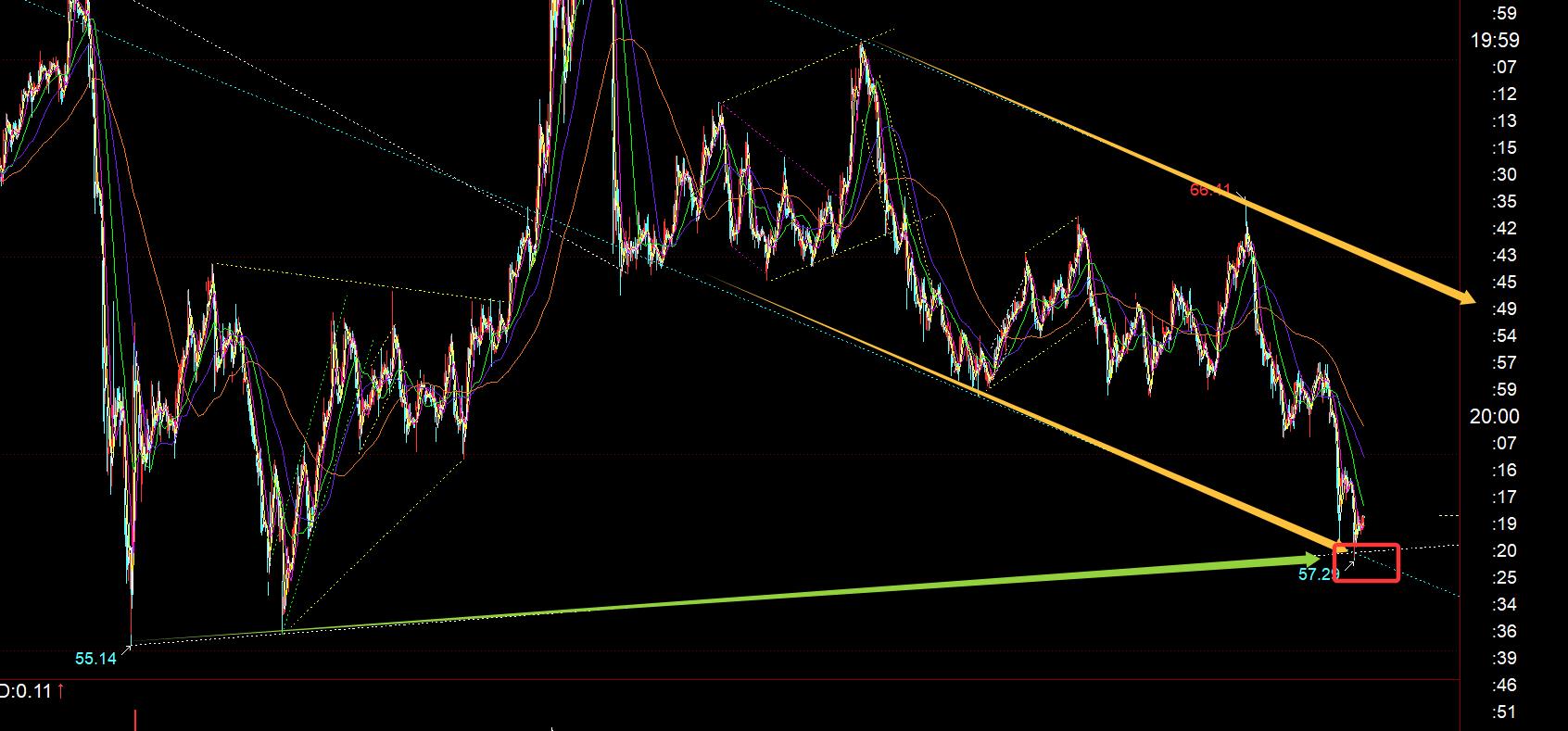

Third, the golden hourly level: the Asian market has directly pulled up strongly, which is still a little surprising. The overnight closing itself was not at a relatively high level, and was still 40 meters away from the previous high, so I thought early in the morning that I would not be able to continue the rise directly; but in fact, I still went for a short squeeze. After the European market reached the 4218 line on the yellow channel in the chart, there was a sharp drop, with the lowest being 4165. This wave of suppressed highs was predicted in place (4215 was warned in advance to pay attention to resistance suppression), but 4165 was low The point touch time is only a few seconds, and you can only choose to win at 4180-4190; judging from the current trend, tonight I tend to see a stronger consolidation at the high level. The resistance is still the derivative level of the upper track of the yellow channel, which will move up to 4220-25. src="/uploads/2025/10/k0yfodw5353.jpg" />

Silver: On the daily level, it stepped back on the 5 moving average yesterday. It was also a strong unilateral pull all the way up, with consecutive yang and single yin movements, so it is likely to close in yang today; from the chart, it is also expected to be stronger tonight, operating within a circle, with resistance at 53.2 and support at 5 1-51.9, the bullish trend is mainly bullish, because the trend of silver this year will increase much more than that of gold, and it will continue to make up for the increase unilaterally; you will see that even if gold falls sharply during the day and corrects, silver will only fall slightly, while gold pulls up, silver will rise more powerfully;

In terms of crude oil: The lower rail of the yellow channel and the green trend line support the resonance point. They were basically tested last night, and there was some rebound. This week's video has already mentioned it; then we will see the strength of the rebound, with resistances of 60 and 61.4 unchanged;

The above are several views of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day for twelve years. Every day Technical points will be made public, and xmspot.combined with text and video interpretations, friends who want to learn can xmspot.compare and reference based on the actual trend; those who agree with the idea can refer to the operation, take good defense, and risk control first; those who do not agree, just ignore it; thank you for your support and attention;

[The opinions in the article are for reference only, investment is risky, you need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and be responsible for profits and losses]

Written by Person: Zheng Shi Dianyin

Reading and researching the market for more than 12 hours a day, insisting on it for ten years, making detailed technical interpretations public on the entire network, and serving to the end with sincerity, dedication, sincerity, perseverance, and wholeheartedness! Write xmspot.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content The entire content about "[XM Official Website]: Gold continues to rise, and the high level of 4170-4225 will be strong tonight" is carefully xmspot.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here