Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Tariff negotiations in China and the United States boost market sentiment, WTI c

- The US dollar against Swiss franc tests the 0.81 mark, Swiss franc crash alert!

- The daily line is at its peak, and gold and silver are low and waiting for a new

- Gold is ready to rise, and it is firmly bullish during the day!

- The moonline breaks the triangle, and the gold, September and October continue t

market news

Strongly wash the cross star, gold and silver step back low

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the thousands of white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Strongly wash the cross star, gold and silver pull back to low long". Hope it will be helpful to you! The original content is as follows:

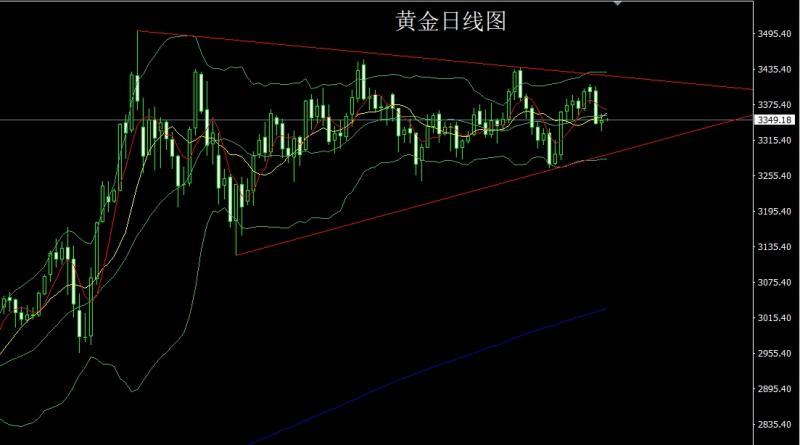

Yesterday, the gold market fluctuated wide range. In the morning, the market opened at 3343.7 and then the market first rose, and then the market fluctuated. Before the US market started, the market was at the lowest level of 3335.6 and then the market started. After the US market started, it quickly rose due to fundamentals. After the market fell sharply, the daily line was at the lowest level of 3330.8 and then rose twice at the end of the market. The daily line was at the highest level of 3330.8 and reached the highest level of the daily line. After reaching the position of 3359.3, the daily line finally closed at the position of 3348.1, and the market closed in a spindle pattern with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, there is a long demand for today's market. At the point, the early trading fell back 3336 long conservative 3333 long stop loss 3329, the target is 3353 and 3360, and if the break is 3365 and 3372-3376.

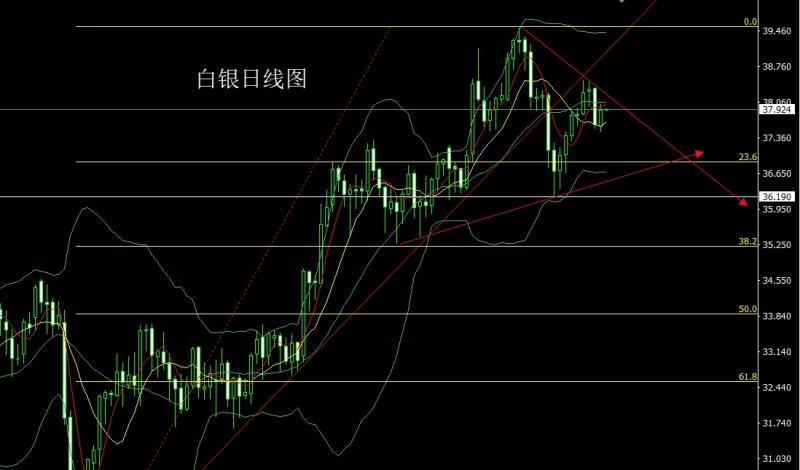

The silver market opened at 37.59 yesterday and the market fell first. The daily low of 37.486 was given a strong fluctuation and lift. The daily line reached the highest position of 38.015 and then the market consolidated. After the daily line finally closed at 37.9, the daily line closed with a medium positive line with an upper and lower shadow line. After this pattern ended, the 37.7 long stop loss was 37.5 today, and the target was 38.1 and 38.3 and 38.5.

European and American markets opened at 1.16103 yesterday and the market rose slightly. After the market fell, the daily line was at the lowest point of 1.15974, the market rose strongly due to fundamentals. The daily line reached the highest point of 1.16976 and then the market consolidated. The daily line finally closed at 1.16725 and then the market closed with a large positive line with an upper shadow slightly longer than the lower shadow. After this pattern ended, the stop loss of 1.16450 is more than 1.16250 today, and the target is 1.16950 and 1.17200 and 1.17400.

The US crude oil market opened at 64.22 yesterday and the market first rose to 64.53 before the market fell back through the layer. The daily line was at the lowest point of 63.23 and then the market consolidated. After the daily line finally closed at 63.27, the daily line closed with a large negative line with a longer upper shadow line. After this pattern ended, the daily line was double negative and the yang line was under the pressure of falling. At the point, today's 64 short stop loss 64.5 today's target below 63.2 and 62.7 and 32.4.

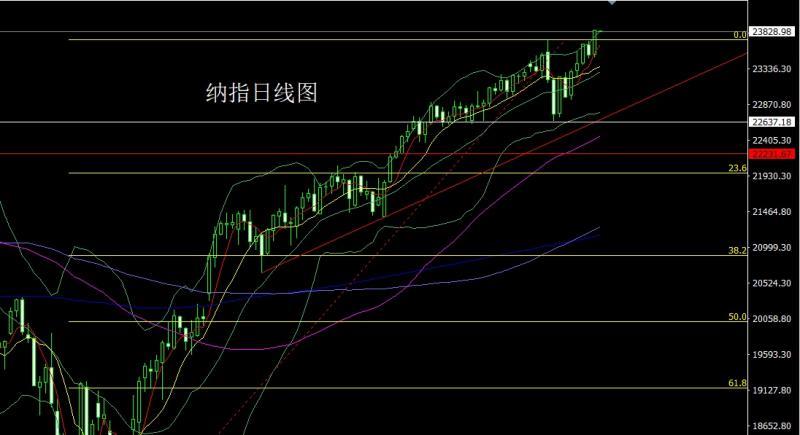

Nasdaq market opened at 23526.86 yesterday and the market fell first to give the position of 23490.6. Then the US market rose strongly by the shadow of favorable fundamentals. The daily line reached the highest point of 23850.19 and then consolidated. The daily line finally closed at 23844.14. Then the market closed with a saturated large positive line with a slightly longer lower shadow line. After this pattern ended, it was more than 23700 today, with a stop loss of 23640, and the target was 23850 and 23900 and 23950.

Fundamentals, yesterday's fundamentals latest data from the US Treasury Department showed that the total amount of US Treasury exceeded US$37 trillion for the first time. US Treasury Secretary Bescent said that the Federal Reserve should consider cutting interest rates by 50 basis points in September. The US CPI annual rate in July was lower than expected, while the core CPI annual rate rose to a five-month high. The US President said that Powell must cut interest rates now and consider allowing major lawsuits against Powell. The market has increased the bet on the Fed's interest rate cut in September. Therefore, after the data, the US index fell sharply, with gold, silver and non-US currencies rising. Today's fundamentals mainly focus on the EIA crude oil inventories from 22:30 to the week of August 8 and the EIA crude oil inventories in Oklahoma in the week of August 8 and the EIA Oklahoma Cushing crude oil inventories in the week of August 8 and the EIA strategic oil reserve inventory inventories in the week of August 8.

In terms of operations, gold: first fell 3336 in the morning, 33333 long stop loss 3329, the target is 3353 and 3360, if the break is 3365 and 3372-3376.

Silver: 37.7 long stop loss today 37.5, target 38.1 and 38.3 and 38.5.

Europe and the United States: 1.16450 long stop loss today 1.16250, target 1.16950 and 1.17200 and 1.17400.

US crude oil: 64 short stop loss today 64.5, target 63.2 and 62.7 and 32.4.

Nasdaq: Today is more than 23,700, stop loss is 23,640, and target is 23,850, 23,900 and 23,950.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Strongly wash the cross star, gold and silver pull back to low long", which was carefully xmspot.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here