Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Chinese live lecture today's preview

- Gold fell sharply in the morning and rose in a small V. It will be expected to s

- Bearish pressure intensifies after the US dollar index falls below the 50-day mo

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- The trade war escalates in full swing, and analysis of short-term trends of spot

market news

The daily line is at its peak, and gold and silver are low and waiting for a new high

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The daily line is at its peak, and gold and silver are at low prices and waiting for a new high." Hope it will be helpful to you! The original content is as follows:

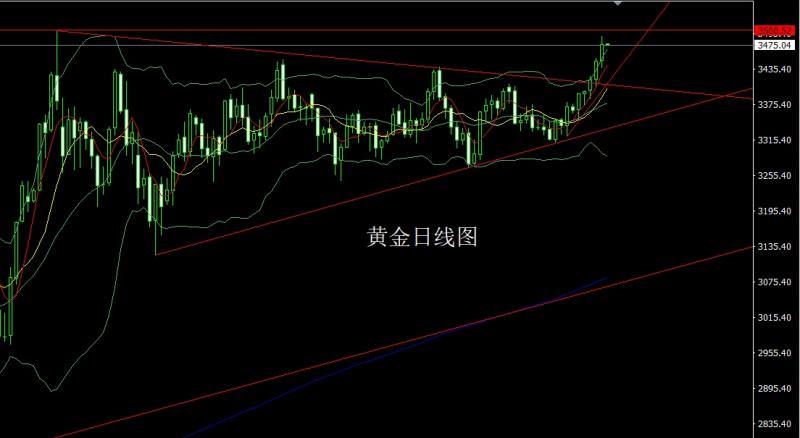

Yesterday, the gold market continued to rise. After the opening at 3449.5 in the morning, the market fell first. The daily line was at the lowest point of 3436.7 and then the market rose strongly. After breaking the high point of last week, the market reached the highest point of 3490 and then the market consolidated. The daily line finally closed at 3476.5. After the daily line closed with a large positive line with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, today's market rebounded and continued to rise for a long time, and at the point. , the stop loss after the reduction of positions in the 3325 and 3322 below was held at 3350, last week, the long and 3377 and 3385 long and 3385 long and 3390 long and 3390 long and 3460 long and 3456 today, the target is 3472 and 3480, and the break is 3485 and 3491 and 3500. If the break is above and enters a new field, look at 3523 and 3532 and 3543-3550

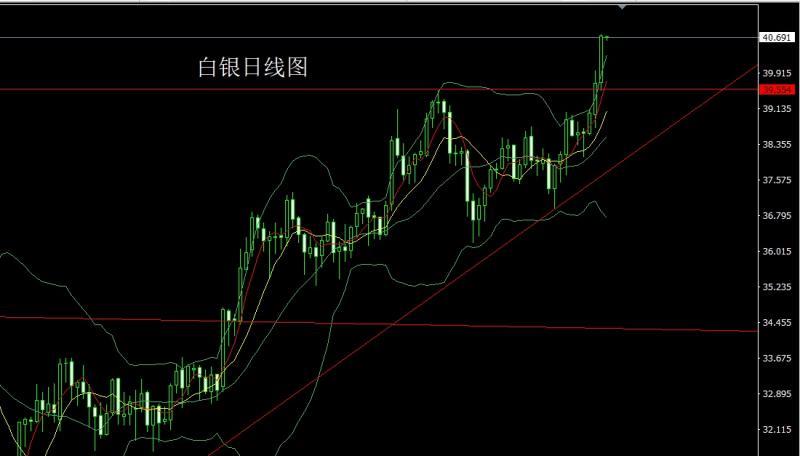

The silver market opened at 39.7 yesterday and then the market rose strongly. The daily line reached the highest point of 40.758 and then the market consolidated. The daily line finally closed at 40.721 and then the market closed with a large positive line with a long lower shadow line. After this pattern ended, the retracement continued to be long today. At the point, the long position of 37.8 below was reduced and the stop loss followed up at 38.3. Last Friday, the stop loss followed by 39 after reducing positions at 38.8, and today's 40.3Long stop loss 40.1, target 40.7 and 41 and 41.2-41.5.

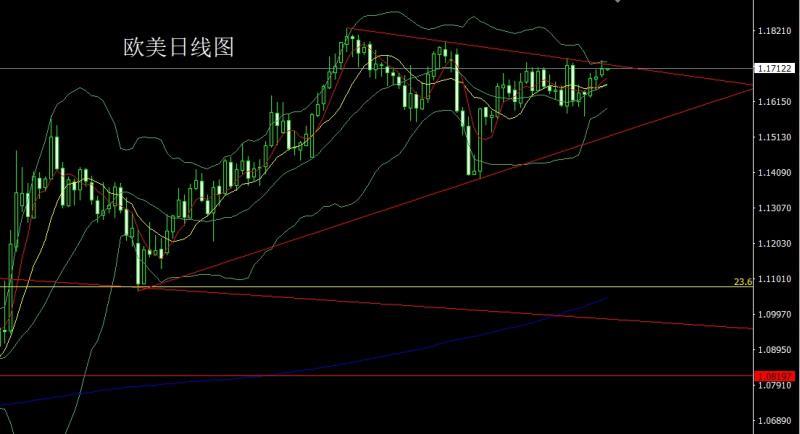

European and American markets opened at 1.16938 yesterday and the market fell first. The daily line was at the lowest point of 1.16856 and then the market fluctuated and rose strongly. The daily line reached the highest point of 1.17362 and then the market surged and fell. The daily line finally closed at 1.17108 and then closed in an inverted hammer head pattern with a very long upper shadow line. After this pattern ended, the stop loss of 1.16950 today was 1.16750, and the target was 1.17300 and 1.17500 and 1.17700.

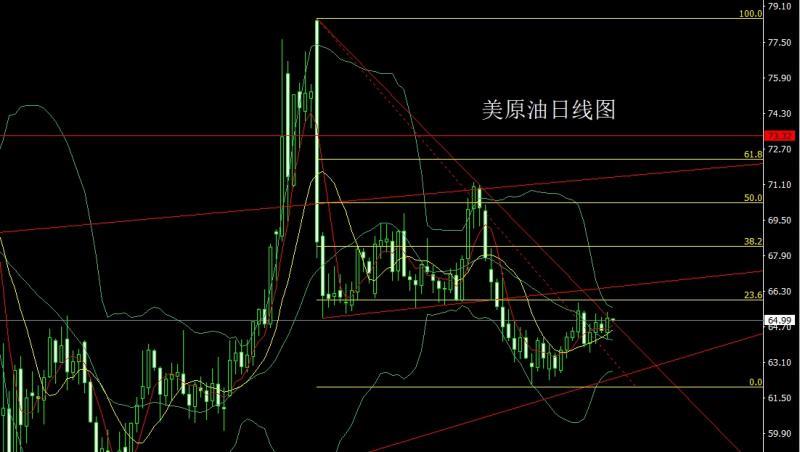

The U.S. crude oil market opened at 64.42 yesterday and the market fell first. The daily line was at the lowest point of 64.12 and then the market rose strongly. The daily line reached the highest point of 65.35 and then the market consolidated. After the daily line finally closed at 65.07, the daily line closed with a medium-positive line with an upper and lower shadow line. After this pattern ended, 64.5 was more than 64, with a target of 65 and 65.35, and 65.75 and 66-66.35-66.5.

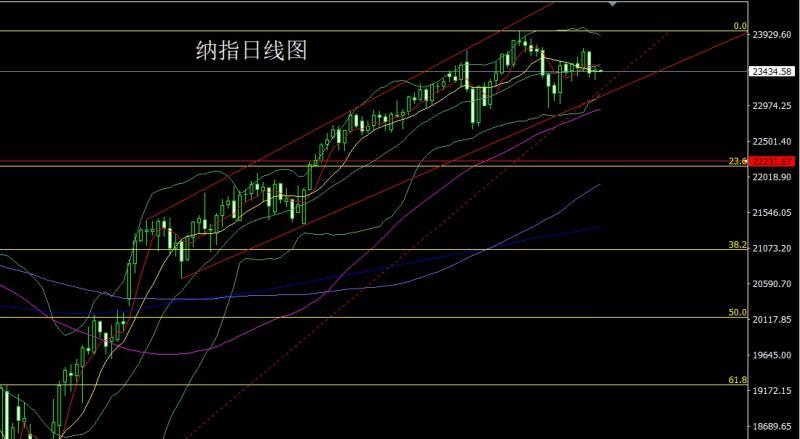

Nasdaq market opened at 23429.54 yesterday and the market rose first. The daily line reached the highest point of 23505.38 and then the market fell. The daily line was at the lowest point of 23320.78 and then the market rose. The daily line finally closed at 23452.5, and the market closed in a hammer head with a long lower shadow line. After this pattern ended, the stop loss of 23350 was more than 23290 today. The target was 23460 and 23510 and 23560-23600.

Basent, yesterday's fundamentals, Becent said that the US president may declare a national housing emergency this fall, and the plan may include exemption of building materials. Confidant that the Supreme Court will support Trump's tariff policy. If passed, this policy will help the current president's winning rate in next year's midterm elections. Today's fundamentals focus mainly on the initial value of the CPI annual rate of the euro zone in August at 17:00. At night, we will see the final value of the US S&P Global Manufacturing PMI in August at 21:54, and at night, we will see the final value of the US August ISM Manufacturing PMI in August at 22:00 and the monthly rate of construction expenditure in July at 22:00.

In terms of operation, gold: the 3325 and 3322 below the long position reduction and the stop loss follow up at 3350. The 3368-3370 long position reduction and the stop loss follow up at 3390. Today, 3463 long position reduction and 3460 long is accurate 3456, the target is 3472 and 3480, the break is 3485 and 3491 and 3500, if the break is above and enters a new field, look at 3523 and 3532 and 3543-3550

Silver: The stop loss is followed by the long position reduction of 37.8 below. Last Friday, the stop loss followed by 39 after reducing positions at 38.8, 40.3, 40.1 today, the target was 40.7 and 41 and 41.2-41.5.

Europe and the United States: 1.16950, the target was 1.16750 today, the target was 1.17300 and 1.17500 and 1.17700.

U.S. crude oil: 64.5, the target was 64 and 65.35 today, the target was 65.75 and 66-66.35-66.5.

Nasdaq Index: Today's 23350 stop loss is 23290, with a target of 23460 and 23510 and 23560-23600.

The above content is all about "[XM official website]: The daily line is at its peak, and gold and silver are at low and waiting for new highs". It is carefully xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here