Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- What's wrong with the euro? European Chemical Industry is trapped in a double ki

- The upward trend remains unchanged! Where will this wave go?

- Rate cut expectations undermine the US index, gold and silver profits delay lowe

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- 8.19 gold bulls cover the market and restart the downward mode

market analysis

Donkey elephants quarrel to push for risk aversion, gold and silver hit new highs

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: Donkeys and elephants quarrel to promote risk aversion, and gold and silver hit a new high." Hope it will be helpful to you! The original content is as follows:

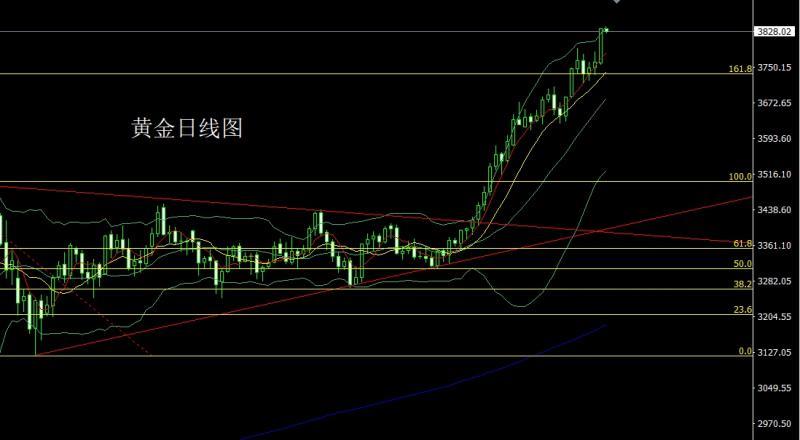

Yesterday, the gold market continued to pull up. After the opening at 3759.9 in the morning, the market fell first. The daily line was at the lowest point of 3756.3 and then the market fluctuated strongly. The daily line reached the highest point of 3834.2 and then consolidated. After the daily line finally closed at 3833.9, the daily line closed with a saturated large positive line with a slightly shadow line. After this pattern ended, today's market fell back to the long. At the point, the long position of 3325 and 3322 below and the long position of 3368-3370 last week and the long position of 3377 and 3385 long and 3563 long and 3563 long and 3650 held at 3650. Today, 3805 long and 3802 long stop loss 3798, the target is 3838 and 3845 and 3852-3855 pressure.

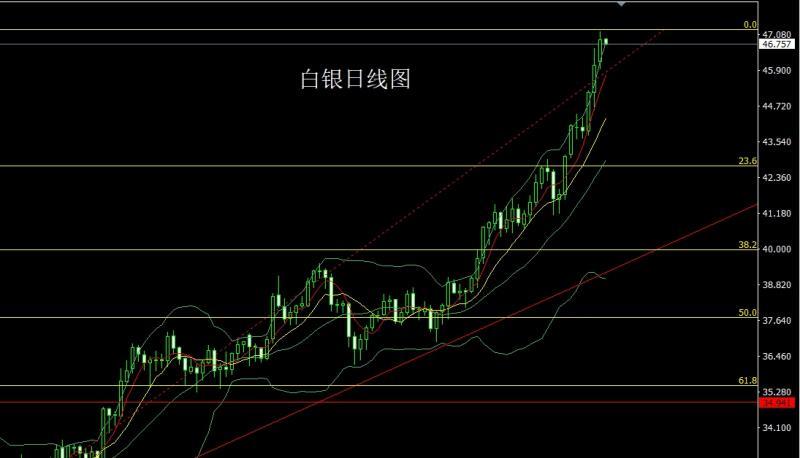

The silver market opened at 46.168 yesterday and the market fell first. The market rose strongly. The daily line reached the highest position of 47.187 and then the market consolidated. After the daily line finally closed at 46.903, the daily line closed with a medium positive line with an upper and lower shadow line. After this pattern ended, the long 37.8 below and the long 38.8 below and the long 38.8 on Friday reduced positions and the stop loss followed up at 42. Last Friday, the stop loss was followed by 44.8 after reducing positions at 44.6, and today the stop loss was 46.2, the target was 46.7 and 46.9 and 47.2, and the break was 47.5 and48.

European and American markets opened at 1.17012 yesterday and the market slightly fell back to 1.16985. After the market fluctuated strongly. The daily line reached the highest point of 1.17548 and then the market consolidated. After the daily line finally closed at 1.17266, the daily line closed with a medium-positive line with a long upper shadow line. After this pattern ended, the stop loss of more than 1.17000 today was 1.16800, the target was 1.17400 and 1.17550, and the break was 1.17750 and 1.18000.

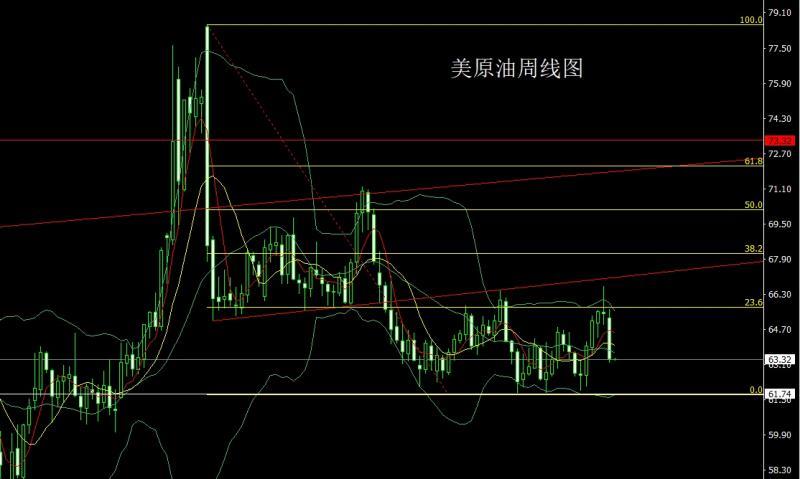

The US crude oil market opened slightly lower yesterday at the position of 65.22, and then the market first rose and filled the gap. The daily line was under pressure and fell. The daily line was given the lowest point of 63.19 and then consolidated. The daily line finally closed at the position of 63.35, and the market closed with a large negative line with a longer upper shadow line. After this pattern ended, it was 64.3 short stop loss today. The target below was 63.5 and 63.2, and fell below 63 and 62.7-52.5.

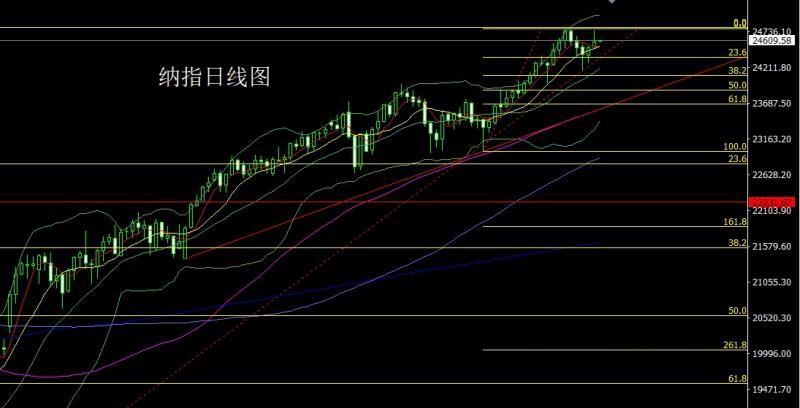

The Nasdaq market opened at 24515.42 yesterday and then the market fell back to 24496.29. The market rose strongly. The daily line reached the highest point of 24948.93 and then fell at the end of the trading session. After the daily line finally closed at 24584.87, the daily line closed in an inverted hammer head with a long upper shadow line. After this pattern ended, it was 2470 today. 0 short stop loss 24760, the target below is 24600 and 24500 and 24450.

The fundamentals, yesterday's fundamentals were affected by the possible shutdown of the US government. The US dollar index fluctuated downward, which stimulated the gold market to rise and hit a new high again. The U.S. Senate Republicans will vote again on a bill to avoid the federal government's shutdown today, and Democrats rejected the short-term temporary spending bill. If it still cannot pass, the US government will shut down and risk aversion will continue to advance. Today's fundamentals focus mainly on the monthly rate of the US July FHFA House Price Index at 21:00 and the annual rate of the US July S&P/CS 20 major cities without seasonal adjustments. Look later at the US September Chicago PMI at 21:45 and US August JOLTs job openings and US September Consulting Chamber of xmspot.commerce Consumer Confidence Index.

In terms of operation, gold: 3325 and 3322 of the lower and 3322 of the long and 3377 and 3385 of the long and 3563 of the last week, the stop loss followed up at 3650, today 3805 long conservative 3802 long stop loss 3798, target 3838 and 3845 and 3852-3855 pressure.

Silver: The long position at 37.8 below and the long position at 38.8 last Friday, the stop loss followed up at 42. Last Friday, the stop loss followed by the 44.6 position reduction at 44.8, today's 46.2 long stop loss 46, the target is 46.7 and 46.9 and 47.2, and the break is 47.5 and 48.

Europe and the United States: 1.17000 today's 1.16800, the target is 1.17400 and 1.17550, the break is 1.17750 and 1.18000.

U.S. crude oil: 64.3 short stop loss 64.55 today , the target below is 63.5 and 63.2, and the target below is 63 and 62.7-52.5.

Nasdaq Index: Today is 24700 short stop loss of 24760, and the target below is 24600 and 24500 and 24450.

The above content is all about "[XM Foreign Exchange Market Review]: Donkeys and elephants quarrel and promote risk aversion, and gold and silver hit a new high", which is carefully xmspot.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here