Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The money market has begun to stabilize, and this week it is closely watched Pow

- Practical foreign exchange strategy on August 20

- US dollar suppresses below 98, US and Europe reach a trade agreement

- Trump announces about 100% tariffs on chips, gold prices are affected by investo

- The expectation of interest rate cuts is favorable to gold. Can the technical si

market news

Core PCE data in August hits, Swiss National Bank expects to maintain zero interest rates

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Forex will bring you "[XM Group]: The core PCE data of the United States in August is xmspot.coming, and the Swiss National Bank is expected to maintain zero interest rates." Hope it will be helpful to you! The original content is as follows:

XM foreign exchange market prospect: The core PCE data in the United States in August is xmspot.coming, and the Swiss National Bank is expected to maintain zero interest rates

XM forward: The importance of economic data to be released this week is from high to low: US August PCE data, Swiss National Bank interest rate resolution, and European and American countries' August PMI data. Next, we will interpret it one by one.

▲XM chart

At 20:30 this Friday, the US Department of xmspot.commerce will release the annual rate data of the US core PCE price index in August, with the previous value of 2.9%, and the expected value remains unchanged. PCE data resonates with CPI data. The latest annualized value of the core CPI in August was 3.1%, the same as the previous value. Based on this, it is very likely that the core PCE data in August will remain the same as in July. The core PCE annual rate data is the core basis for the Federal Reserve to make monetary policy adjustments, and the stable data performance is conducive to the Federal Reserve maintaining the current interest rate cut trend. The weak performance of the U.S. labor market has caused the Federal Reserve to shift its focus from PCE data to non-farm employment reports. In the interest rate decision in September, the Federal Reserve announced a 25 basis point rate cut because the United States added only 22,000 new non-farm employment in August, which is too far from the peak of 323,000 in 2024. On the one hand, the expected value of PCE data is the same as the previous value, and on the other hand, the labor market data has attracted the attention of the Federal Reserve. The release of PCE data on Friday this week may have limited impact on the US dollar and gold markets.

▲XM chart

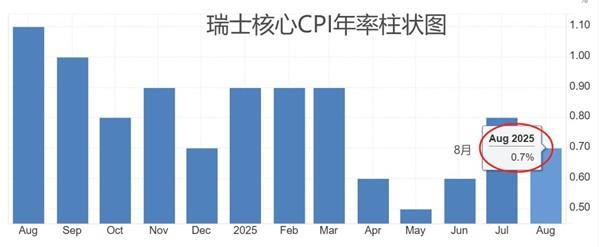

This Wednesday at 15:30, the Swiss National Bank will announce the results of the September interest rate resolution. The mainstream expectations remain unchanged and the zero interest rate remains unchanged. Switzerland's macroeconomic is special, the inflation rate continues to be sluggish, and there is no high inflation phenomenon in major developed countries. In August, the annual rate of Switzerland's core CPI was 0.7%, lower than the previous value of 0.8%, far below the moderate inflation standard 2%. Weak inflation corresponds to loose monetary policy. In June, the Swiss National Bank announced a 25 basis point interest rate cut, and the benchmark interest rate officially entered zero time. Generation. When the interest rate in the United States is still as high as 4.00~4.25%, Switzerland is the first to enter the zero interest rate era, which will put significant pressure on the currency value of the Swiss franc. Even the ECB, which has repeatedly cut interest rates, the benchmark interest rate is still as high as 2.15%, which is a clear advantage over the Swiss interest rate. It should be noted that the Swiss franc has the attributes of hedging. In the state of high global macroeconomic uncertainty, even if the Swiss franc enters the zero interest rate era, it cannot stop the influx of safe-haven funds. Therefore, the Swiss franc still has the possibility of appreciation against the US dollar and the euro.

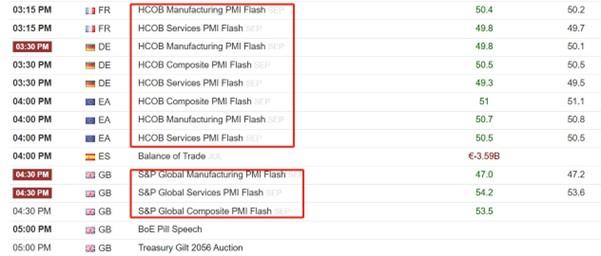

This Tuesday, mainstream developed countries successively released manufacturing PMI data. During the European session, France, Germany, the euro zone and the United Kingdom will release manufacturing PMI data in September in turn, with the previous values being 50.4, 49.8, 50.7, and 47 respectively, with the expected values being 50.2, 50, 50.9 and 47 respectively. Among them, France's expectations decline, Germany and the euro zone expectations rise, while the UK's expectations remain unchanged. Overall, Europe's manufacturing prospects are good, except for the United Kingdom, the expected values are higher than the 50 boom line. The US manufacturing PMI data will be 21:4 on Tuesday 5 announced, the previous value is 53, the expected value is 52, and the expected decrease is 1 percentage point. Since the absolute value is still above the 50 boom and bush line, even if the announced value drops slightly, the impact on the US dollar index is expected to be relatively limited.

XM Risk Warning, Disclaimer, Special Statement: The market is risky, and investment should be cautious. The above content only represents the personal views of the analyst and does not constitute any operational suggestions. Please do not regard this report as the only reference basis. In different periods, the analyst's views may change, and the update will not be notified separately.

The above content is about "【XM Group]: The core PCE data in the United States in August is xmspot.coming, and the Swiss National Bank expects to maintain zero interest rates" is carefully xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thank you for your support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life today. I will work hard to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here