Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

We offer a superior trading environment that puts traders in the best position to profit.

Easy Access to 1,400+ Global Assets

EURUSD

Euro vs U.S. Dollar

US500

S&P 500 (US500)

GOLD

Gold

COFFEE

US Coffee

Apple

Apple (AAPL.OQ)

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

Awarded BestBrokerYear After Year

CATEGORIES

News

- The pound 1.34 defense line sounds the "air raid alarm", and the "hawkish rebell

- US dollar index fell sharply after U.S. labor market data released

- There are obvious signs of bulls controlling the market, and the Australian doll

- Bank of Canada's interest rate decision is coming, and the probability of keepin

- Guide to short-term operations of major currencies on August 4

market analysis

Strong fluctuations are coming under pressure, and gold and silver need more retracement

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Strong fluctuations are under pressure, and gold and silver will need to fall back." Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market opened at 3368.9 in the morning and then the market fell slightly and gave the position of 3364.8. After the market fluctuated strongly. During the US session, the daily line reached the highest position of 3402 and then the market consolidated. The daily line finally closed at 3396.7. Then the market closed with a large positive line with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, the daily line was positive and negative. Today, it needed to retrace more. At the point, the stop loss of 3372 was held at 3371 after reducing positions yesterday. Today, 3377 was conservative and 3375 was more stop loss 3371. The target was 3395 and 3402, and the break was 3412 and 3422 and 3430-3440 pressure.

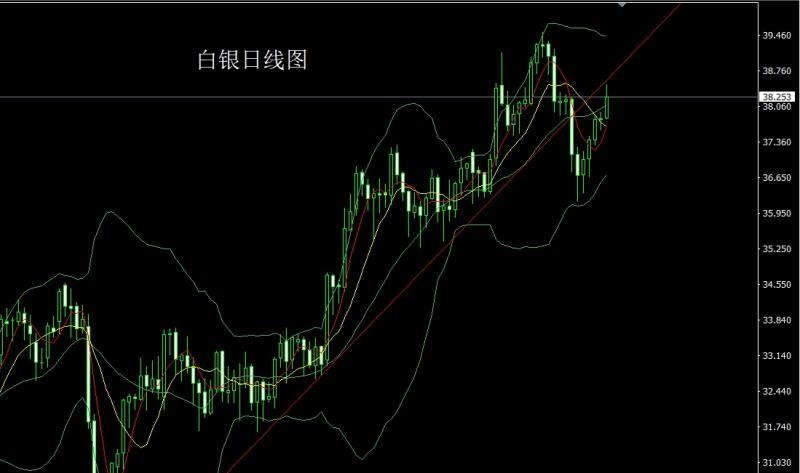

The silver market opened at 37.829 yesterday and the market fell slightly and gave the 37.805 position. After the market rose strongly, the daily line reached the highest point of 38.5 and then the market fluctuated and consolidated. After the daily line finally closed at 38.251, the daily line closed with a medium-positive line with a long upper shadow line. After this pattern ended, the 38.05 stop loss was 37.85 today, the target was 38.5, and the break was 38.75 and 39-39.2

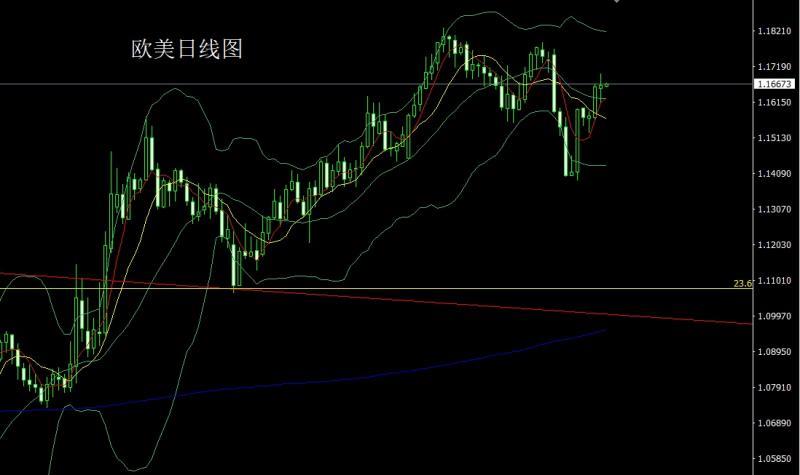

European and American markets opened at 1.16553 yesterday and the market rose first. The daily line reached the highest position at 1.16987 and then the market fell. The daily line was at the lowest position at 1.16096 and then the market consolidated. The daily line finally closed at 1.16635 and then the market closed with a long-leg cross star pattern with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the stop loss after reducing positions at 1.16150 yesterday was followed by 1.16200, and the stop loss after 1.16400 was more than 1.16200 today. The target was 1.16800 and 1.17000, and the break was 1.17200 and 1.17400.

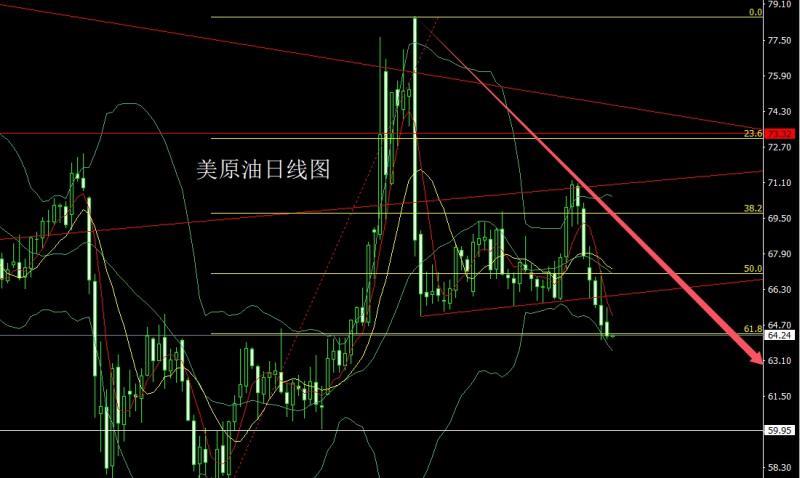

The US crude oil market opened at 64.81 yesterday and then the market first rose to 65.5. Then the market fluctuated strongly. The daily line was at the lowest point of 64.07 and then the market consolidated. The daily line finally closed at 64.19 and then the market closed with a very long upper shadow line. After this pattern ended, today's short stop loss of 65.6, the target below 64.5 and 64.05, and below 63.6 and 63.1.

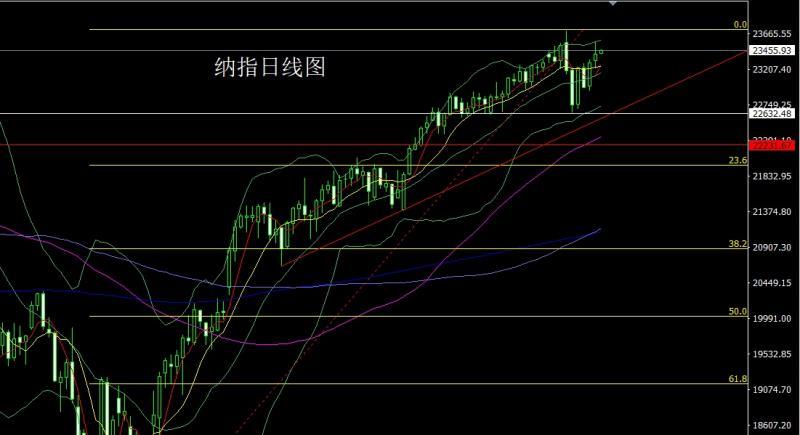

The Nasdaq market opened at 23316.84 yesterday and the market fell slightly. The market fluctuated strongly. The daily line reached the highest position of 23562.15 and then fell strongly. The daily line was at the lowest position of 23220.85 and then the market rose at the end of the trading session. The daily line finally closed at 23410.16 and then the market was in a strong position. A spindle pattern with an upper shadow line slightly longer than the lower shadow line closed. After such a pattern ended, the stop loss was 23230 after more than 23290 today, with the target of 23350 and 23400 and 23450-23500.

The fundamentals, yesterday's fundamentals, the US President nominated Stephen Milan, Chairman of the White House Economic Advisory xmspot.committee, as a member of the Federal Reserve, and his term of office was until January 31, 2026. US Treasury Secretary Bescent: The interview process for the Fed Chairman has begun, and the timetable for replacing Fed Chairman Powell has accelerated, which means that the Fed's expectation of a rate cut has increased, which will further suppress the US index and push up gold and silver prices. Today's fundamentals mainly focus on the number of jobs in Canada in July at 20:30.

In terms of operation, gold: yesterday's 3372's long position reduction and the stop loss follow-up is held at 3371. Today, 3377 is conservative and 3375 is long and stop loss is 3371. The target is 3395 and 3402. The break is 3412 and 3422 and 3430-3440 pressure.

Silver: 37.85, 38.05 today, target 38.5, breaking the position, 38.75 and 39-39.2

Europe and the United States: 1.1 yesterday6150's long position reduction follow-up at 1.16200, 1.16400 today's stop loss 1.16200, target 1.16800 and 1.17000, breaking the position and 1.17200 and 1.17400.

US crude oil: 65.1 short stop loss 65.6 today's short stop loss 64.5 and 64.05, below the target, below the target, 63.6 and 63.1.

Nasdaq: 23290 today's stop loss 23230, target, target, 23350 and 23400 and 23450-23500

3372 yesterday

The above content is all about "[XM Foreign Exchange Platform]: Strong fluctuations are xmspot.coming under pressure, and gold and silver need to fall back". It is carefully xmspot.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

Related News

- Five major events to happen in the global market this week2025-08-25

- Gold fluctuates and rises and accumulates momentum, and continues to rise next w2025-08-10

- US dollar index fell, senior Fed officials expressed support for short-term inte2025-08-07

- The US dollar index fluctuates downward, focusing on the interest rate resolutio2025-07-28

- Bank of Japan suggests that the conditions for interest rate hikes are gradually2025-08-26