Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 7.23 Gold rose sharply, and continued to buy after short in the morning

- 8.26 Gold hits the bottom and counterattack, and 87 is out again

- 8.7 Gold was perfectly taken by all yesterday, and the 80-stop area was first in

- A collection of positive and negative news that affects the foreign exchange mar

- Fed interest rate resolution is coming, Trump's pressure on Powell's effect is t

market news

Strongly push the Fed to become chairman, gold and silver safe-haven delays lower and lower

Wonderful Introduction:

I missed more in life than not, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have xmspot.comfort; missing xmspot.comfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Strongly push the Federal Reserve to become chairman, gold and silver risk aversion will be delayed and low". Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market was consolidated in a wide range. The market opened at 3374.8 in the morning and then rose slightly. The market fluctuated and then fell. The daily line was at the lowest point of 3349.3 and then the market rose strongly during the US session. The daily line reached the highest point of 3390.7 and then the market consolidated. The daily line finally closed at 3380 and then closed in a hammer head with a very long lower shadow line. After this pattern ended, today 3357 was conservative 3355 3355 3351, and the target was 3375 and 3385 and 3391. The breaking point was 3400 and 3405-3412.

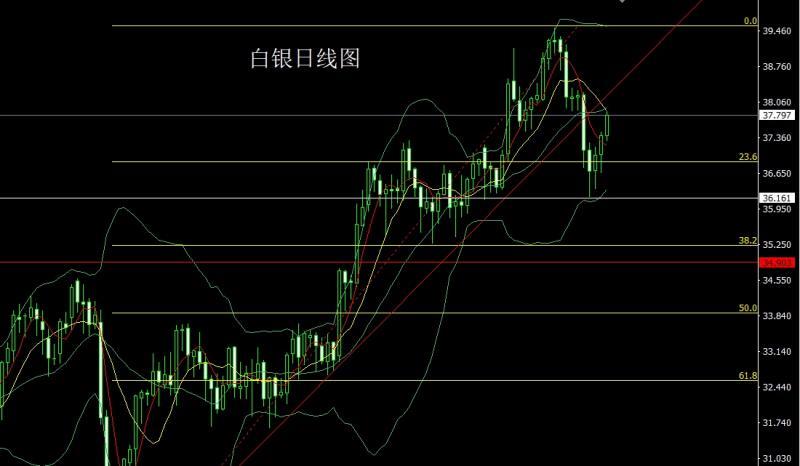

The silver market opened at 37.359 yesterday and the market rose slightly. The market fell rapidly. The daily line was at the lowest point of 37.296 and then the market fluctuated strongly. The daily line reached the highest point of 37.875 and then the market consolidated. After the daily line finally closed at 37.795, the daily line closed with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, today's market rebound continued to rise for a long time. At the point, today's 37.55 stop loss was 37.35.The standard looks at 37.85 and 38 and 38.2-38.4.

European and American markets opened at 1.15687 yesterday and the market rose slightly. The daily line was high at 1.15879 and the market fluctuated and fell. The daily line was at the lowest point of 1.15257 and then the market rose strongly. The daily line finally closed at 1.15753 and then the market closed with a long lower shadow line. After this pattern ended, the stop loss of more than 1.15400 today was 1.15200, and the target was 1.15750 and 1.15900 and 1.16100.

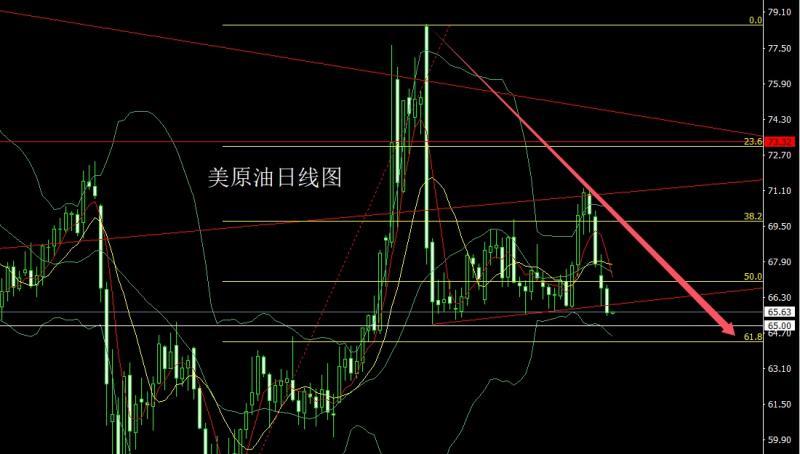

The US crude oil market opened at 66.69 yesterday and the market rose slightly. The market fluctuated strongly and fell. The daily line was at the lowest point of 65.46 and then the market consolidated. The daily line finally closed at 65.62 and then closed with a large negative line with an upper and lower shadow line. After this pattern ended, the daily line effectively broke the support. Today's market fell back to 66.2 short stop loss 66.6 and looked at 65.45 and 65 and 64.6.

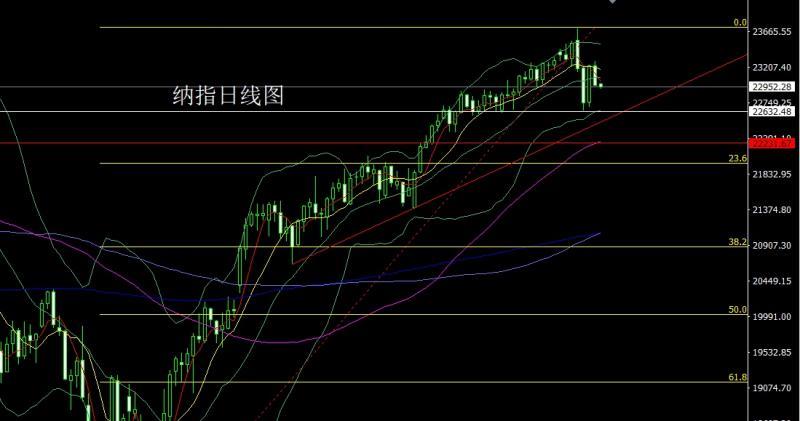

Nasdaq market opened at 23227.51 yesterday and the market fell back to 23192.85. After the market rose, the daily line reached the highest point of 23290.18. After the market fluctuated strongly. The daily line was given the lowest point of 22970.2. Then the daily line was a saturated large negative line with a slightly longer upper shadow line. After this pattern ended, today's short stop loss of 23180 at 23120, the target below is 22970, and the falling below is 22900 and 22820-22800.

Fundamentals, yesterday's fundamentals. The speech of the US president caused a market storm, covering candidates for Federal Reserve Chairmanship and tariffs. He also said he wanted to run for the U.S. president again, but may not do so. "The Fed chairman is political, Powell cut interest rates too late." Many Fed chairman candidates are excellent, Wash is good, and Hassett is very good, and there are two other candidates who may announce a new Fed chairman soon. The U.S. tariffs on semiconductor and drug imports will be announced "around next week", a move that is one of the current administration's efforts to reshape global trade and target key economic sectors. The U.S. non-manufacturing PMI in July fell to 50.1 from 50.8 in June, down from 50.5 in June, down from 51.5 in July. ISM's new order index fell to 50.3 from 51.3 in June, and export orders fell into shrinkage for the fourth time in five months. Affected by this, the US index fell, and the gold, silver and non-US markets rose, and today's fundamentals are mainlyPay attention to the US global supply chain pressure index in July at 22:00, and look at the US crude oil inventories from 22:30 to August 1 in the week of EIA and the US Cushing crude oil inventories from August 1 in the week of EIA to August 1 in the week of EIA to Cushing crude oil inventories from August 1 in the week of EIA to August 1 in the week of EIA to EIA strategic oil reserves inventories from the week of EIA to August 1.

In terms of operation, gold: 3357 long conservative 3355 long stop loss 3351, target 3375 and 3385 and 3391. Breakout 3400 and 3405-3412.

Silver: 37.55 long stop loss 37.35 today, target 37.85 and 38 and 38.2-38.4.

Europe and the United States: 1.15400 long stop loss 1.15200, target 1.15750 and 1.15900 and 1.16100.

>

U.S. crude oil: Today's market rebounds to 66.2 short stop loss 66.6, and the target below is 65.45 and 65 and 64.6.

Nasdaq: Today's 23120 short stop loss 23180, and the target below is 22970, and the target below is 22900 and 22820-22800.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Strongly push the Fed to become chairman, and gold and silver risk aversion delays low and long" is carefully xmspot.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here