Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar index fluctuates sideways, and the EU's tariff counter-attack agai

- Guide to short-term operation of major currencies

- Gold prices continue to hit historical highs, pointing to the 3600 mark, weak US

- The US dollar remains strong, will non-farm data be a turning point?

- Gold is calm, where will it go next week?

market news

The Bank of England may cut interest rates this week, Trump's 10-day deadline for Russia will expire

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: The Bank of England may cut interest rates this week, and Trump's 10-day deadline for Russia will expire." Hope it will be helpful to you! The original content is as follows:

XM Forecast: The importance of economic data to be released this week from high to low is: Bank of England interest rate resolution, Canadian employment, and EIA crude oil inventories. Next, we will interpret it one by one.

▲XM chart

This Thursday at 19:00, the Bank of England will announce the results of the August interest rate resolution. Mainstream expectations believe that it will cut interest rates by 25 basis points, and the benchmark interest rate will drop from 4.25% to 4%. Since the beginning of this year, the Bank of England's monetary policy has followed the law of "interval interest rate cuts", that is, after the last resolution to cut interest rates, this resolution will be suspended, and the next resolution will be cut again. In February this year, the Bank of England decided to cut interest rates by 25 basis points, in March, and in May, it decided to cut interest rates by 25 basis points, and in June, it continued to hold on. Therefore, this month's resolution is likely to follow the rules of rate cuts of 25 basis points. In terms of economic data, the UK's unemployment rate data continues to rise, with the latest value in May at 4.7%, approaching the 5% full employment standard. The Bank of England governor is most worried about unemployment data, and he mentioned in his previous speech: "I do see some potential weakness, especially in the labor market, which is weakening." To cope with the weak labor market problems, it is necessary for the Bank of England to maintain loose monetary policy, which will continue to be negative for the pound.

▲XM chart

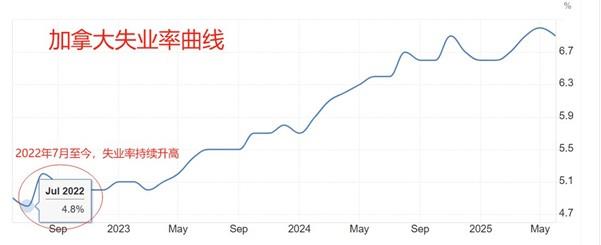

Canada will release a series of labor market data at 20:30 this Friday.Among them, the most popular one is the number of jobs in Canada in July, with the previous value of 83,100, and the expected value is only 13,500, which is very pessimistic. If the final published value is indeed much lower than the previous value, the Canadian dollar will suffer a significant impact. Canada's July unemployment rate is another highly-watched data, with the previous value of 6.9%, an expected value of 7%, and a slightly higher than 0.1 percentage point. 5% is a recognized standard for health unemployment, and Canada has been above this level for three consecutive years. Since June 2024, the Bank of Canada has intensively cut interest rates to boost the labor market, with 7 consecutive interest rates cuts, with a cumulative amplitude of 225 basis points, far exceeding the central banks of other developed economies. ·However, the Bank of Canada has remained silent in the last three periods of interest rate resolutions, mainly because the trade agreement with the United States has not yet been signed and dared not act rashly. If Canadian employment drops sharply as expected in July, the Bank of Canada's interest rate cuts will surely heat up and the Canadian dollar will suffer a significant impact.

▲XM chart

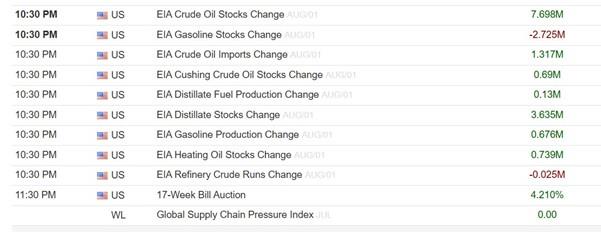

At 22:30 this Wednesday, the US EIA will release the EIA crude oil inventories data until August 1, with the previous value increasing by 7.698 million barrels. In this way, the latest value continues to increase, and the US crude oil price will suffer a significant suppression. Since EIA crude oil inventory data are released every week and have a high frequency, the impact on oil prices is average. The crude oil market will be sensitive to the results of EIA data unless there are continuous increases or interest rate cuts for several consecutive weeks, and there will be major changes in the supply and demand side of crude oil. This week, US President Trump said last week that he would give Russia 10 days to end the issue with Ukraine. According to time calculations, this Thursday to Friday is what Trump calls the deadline. If the two sides fail to reach an agreement, the United States may sanction Russia's oil exports, which will impact the international crude oil supply side, and there is a possibility of a sharp rise in international oil prices. Therefore, this week's EIA crude oil inventory data needs to be closely watched, which may have a far greater impact on international oil prices than usual.

XM risk warning, disclaimer, special statement: The market is risky, so be cautious when investing. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not regard this report as the sole reference. At different times, analysts' views may change and updates will not be notified separately.

The above content is all about "[XM Group]: The Bank of England may cut interest rates this week, and Trump's 10-day deadline for Russia will expire". It was carefully xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transaction! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here